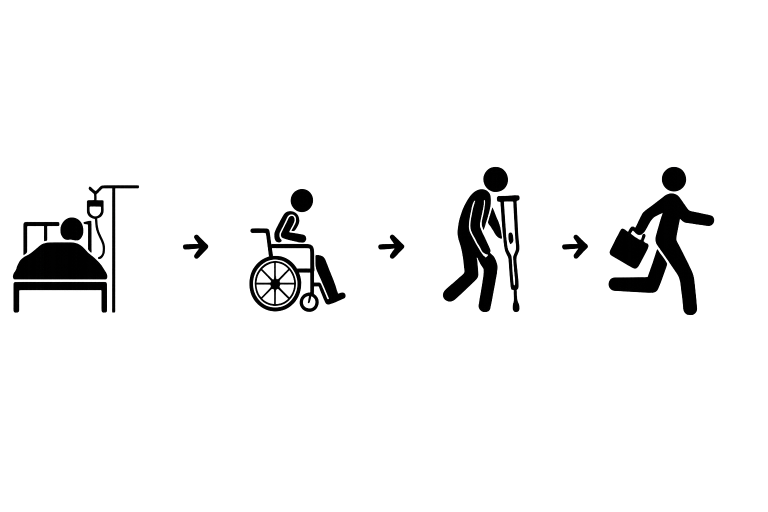

When life throws a curveball, disability insurance steps in. If you’re seriously sick or injured and can’t work, this coverage keeps you afloat. Once your claim is approved, you’ll start getting part of your regular income. This helps you pay for rent, groceries, EMIs, and other essentials—without burning savings.

Policies can pay out for a few months or several years, depending on the plan. As long as you keep up with your premiums, your support stays active.